Business Entities & Tax Strategy

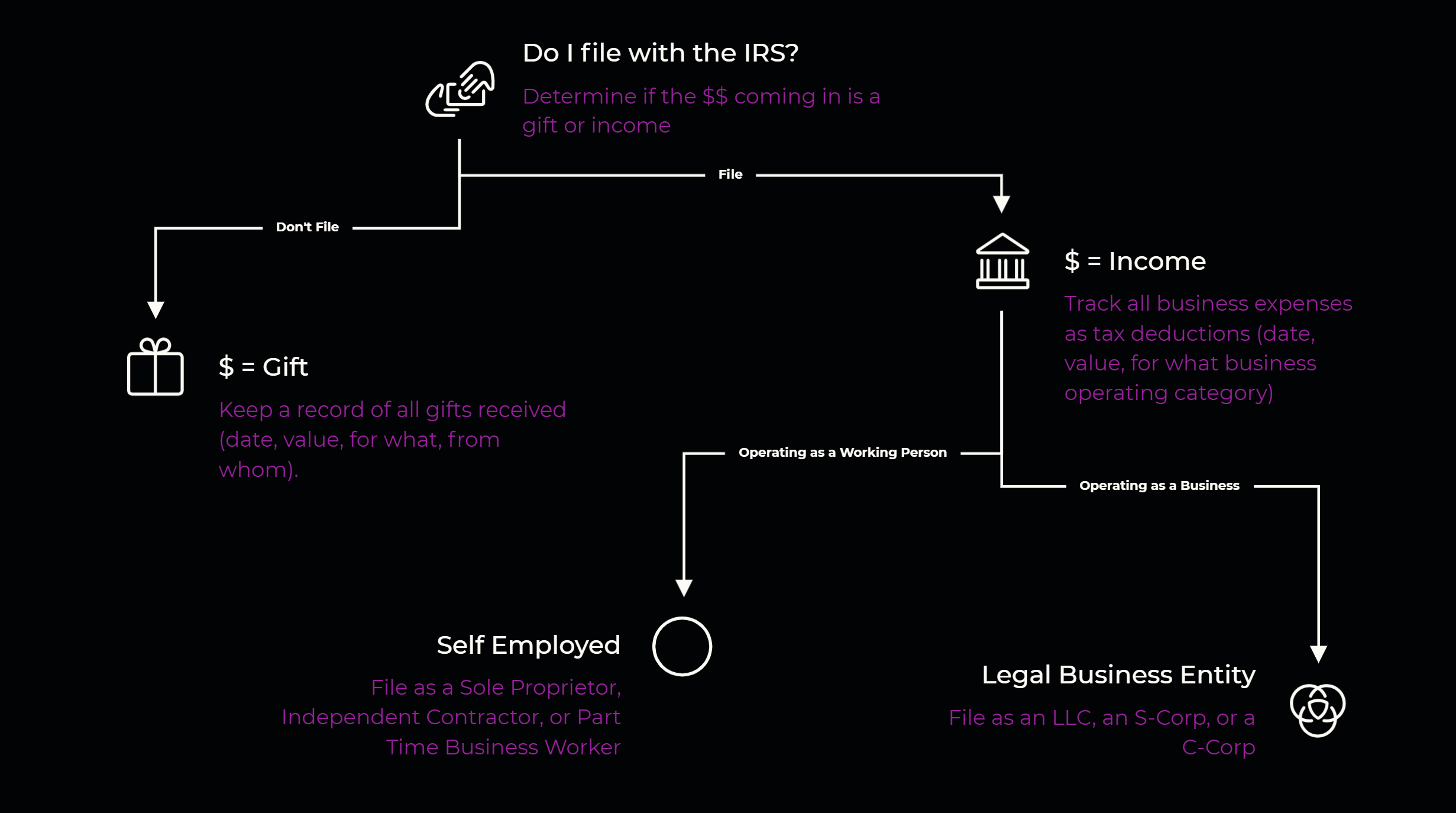

Determine if you’re filing or not… and, if so, how you want to file.

IF YOU’RE FILING…

Reduce your taxable income amount by tracking business expenses

Not sure what to track as expenses?

Include whatever is reasonable and necessary!

Ready to graduate from manual expense tracking? (You are going to do this whether you are self employed or have a legal business entity!)

Upgrade to software, link your business bank account and business credit/debit card. (you still have to “reconcile” expenses for data accuracy even with software. unfortunately, nothing is 100% hands off)

Got a lot of physical cash to deposit?

Alternative Banking solution for higher volume cash businesses…

Ready to start your legal business entity (as opposed to being self employed)?

There are pros and cons to each kind of legal business entity…

Ready to start paying yourself as an employee of the company?

Get yourself on the Company Payroll…

NEED HELP?

Brian (The Kinky CPA) offers free short calls to the adult industry community.